The majority of professional traders and a few novices use the complex trading approach known as CFD trading. Although CFD trading can be profitable, it can also be highly risky because of lax business governance, probable liquidity issues, and the prerequisite to keep a sufficient margin owing to leveraged loss.

Despite this, if certain factors are taken into interest, CFD trading can actually be carried out effectively by upcoming traders too.

To trade, the difference in the sense of a commercial asset between the contract’s initiation and closure hours, a shareholder and a CFD broker initiate a contract for differences (CFD). As such, you would merely bet on how its price will change in place of maintaining the investment product or stock.

The CFD sector is not to be taken lightly, despite possessing a straightforward conceptual foundation. In the parts below, we’ll go over the three key things that an investor new to CFD trading requires to know.

Accessibility and a Weak Administrative Environment

The first part you should examine before starting CFD trading as a newbie is whether they provide the contract in the nation where you reside. Just to mention, CFD contracts are not permitted in the United States of America, while they are in several other populous business nations, such as the United Kingdom, Germany, Switzerland, Singapore, Spain, France, South Africa, Canada, New Zealand, Italy, Thailand, Belgium, Denmark, among others. It also permitted them in registered, OTC markets in these nations.

The CFD trading sector again lacks enough regulatory oversight. This is why it’s critical to choose a decent broker with favorable customer reviews prior to beginning executing important trades with them. Longevity, financial standing, and credibility are extremely important indicators of a CFD broker’s trustworthiness than state recognition or liquidity. Because of this, it is essential to inspect a broker’s backdrop before creating an account with them.

You Have the Choice of Purchasing or Selling

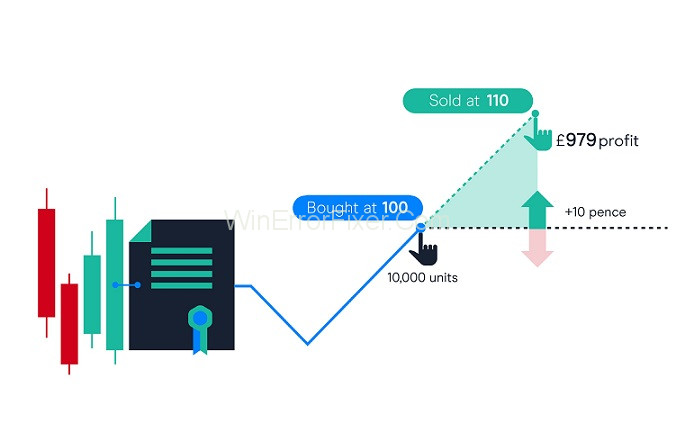

The two values that are occasionally quoted for CFDs are the buying price (offer), at which you can initiates a long CFD, and the closure price (bid), at which you can open a short CFD. Each time, buy prices will be considerably bigger than the market cost, and selling prices will be relatively lower. They term the distinction between the two prices “spread”.

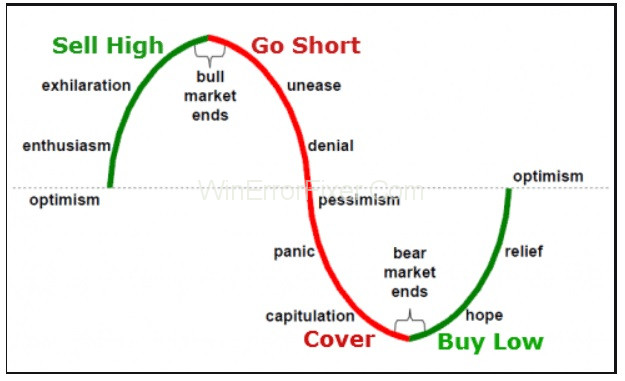

CFD traders frequently use the terms “purchase” and “long” interchangeably. Consequently, you have the alternative to trade regardless of the market’s state—whether it is picking up or declining.

A day trader who is going in a long position has acquired the commodity and is maintaining it in the hope that the price will accelerate. In the variation, you can make short trades in the confidence that the price will drop and you will be able to resell it to another dealer.

Remember that while trading CFDs, you are essentially wagering on the asset’s prospective price swings, and, obviously, it hinges on the path you take, earning the disparity in price along the operation. As a result, you do not own the fundamental commodity or assets.

CFD Requires an Opening Margin

Initial and variation margins are two separate forms of margin that may be involved while they are trading CFDs because they are on the margin. You have the preference to buy an interest in a resource whose value exceeds the available capital while trading Contracts for Difference (CFDs). We know this as leveraging your fund.

While tiny basic security may empower you to execute major transactions for the same measure of payment, you should regularly weigh the probable losses and maintain your trading within your bounds.

A risk examination will inform you how intensely you should penetrate the transaction, provided the extent of your trading account overall. It is entirely feasible for you to blow more on your trade than the initial deposit, especially if the expenditure is small. You shouldn’t always trade more than your ability.

CMC Markets

In general, beginners can register a not-paid-for account that allows CFD trading. Spreads, commissions, margin losses, and modest nightlong swap fees are how CFD brokerages generate revenue. Some brokers charge extra costs for specific functions.

Those are the three considerations of CFD trading that a newbie trader must be cognizant of. Moreover, it should be highlighted that CFDs also contain a few elements that can either be a tremendous profit or the biggest risk factor.

Just to say, someone could not entirely rely leverage on when it arrives at CFDs since it supports you to wager with funds that you don’t acquire by granting you to transact with obtained funds.