If you need quick money and thinking of an instant personal loan, today you will learn how to get loans online without difficulty, and with an excellent selection of quality online loan apps.

Sometimes your bank account doesn’t match your regular spending. You don’t want to discuss your financial problems with friends and family. Then you look for a lender. An easy way to overcome this problem is to apply for a loan online.

Top 10 Online Loan Apps

Personal loans, from big 100k loans to even a small $300 loan are very easy to obtain these days. You can choose the best loan apps to get online loans if you are looking for something particular.

1. StashFin

This application features digital lending. StashFin was designed by financial experts who practice their experience in finance, banking, and technology in various international companies of online loans.

Features and benefits:

- Online loans can be repaid in equal monthly installments only electronically;

- Interest rates from 11.99% per annum;

- A loan term can be at least three months to thirty-six months;

- Apart from processing fees, there are no other hidden fees.

2. SmartcoinLoans

SmartCoin application is a great option when you need quick money and you want to earn some money online. The app allows you to exchange cryptocurrency using a reliable price channel. Moreover, the fixed currency is stable in price while maintaining decentralization.

Features and benefits:

- Loans are provided to professionals, executives and businessmen;

- The loan term varies from fifteen days to four months;

- It is an easy-to-use application with a simple interface;

- Loan processing is in two clicks;

- The money is credited to your account within a few business days.

3. ZestMoney

It is a quick way to get an instant loan online. You can repay your credit digitally in Equal Monthly Installments (EMI). No credit card is required.

- ZestMoney does not require a credit rating;

- The process of obtaining a loan is so simplified that it only takes five minutes;

- Online loans are authorized instantly;

- You can earn 100% cashback on your EMIs;

- As a bonus, you receive a gift card from online partners such as Amazon, Flipkart, Makemytrip, and Myntra.

4. CASHe

Features and benefits:

- The app provides personal loans in a few minutes;

- Loans have a maturity of three to twenty months;

- Unsecured loans are available;

- Instant money to a personal account;

- The interest rate is 11.99%.

- The registration fee is 5% of the loan amount.

5. ePaylater

With this online application, it has become very easy to buy as many things as you want or need immediately.

Features and benefits:

There is a “buy now pay later option” which gives you a 14-day interest-free window from the date you placed your order. Payments can be made to various online stores.

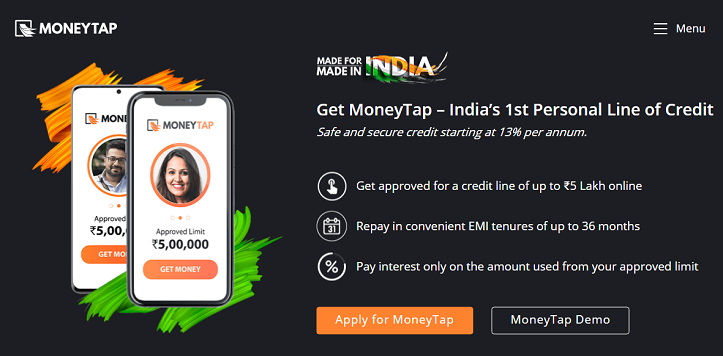

6. MoneyTap

Both individual entrepreneurs and professionals can take advantage of instant loans in this online application. You need to create your profile and upload your documents. Loans online can be obtained only by providing correct information.

Features and benefits:

- MoneyTap will also inform you about the pre-approved loan amounts available to you;

- The rejection rate of loan applications is very low;

- If you do not withdraw the entire authorized amount, you will only be charged interest on the amount you have withdrawn.

7. KreditBee

The Kreditbee app helps young professionals to make their dreams come true. It has the ability to directly transfer money to your bank account.

Features and benefits:

- The entire process is done online, from application to cash out;

- The application process only takes fifteen minutes;

- The monthly interest rate is 3% of the principal;

- The funds are immediately transferred to the applicant’s bank account.

8. LazyPay

This is a rather unique online application. Before you enter all your details, it is possible to access your credit limit by entering your mobile number.

Features and benefits:

- LazyPay authorizes over a million loans per month;

- High level of security;

- 14-day interest-free redemption window;

- The loan is provided with monthly payments equal to a borrower.

9. mPokket

This is quite a peculiar application that is intended for conditional payments made by students. Online loans have now become available not only to businessmen and entrepreneurs! Even young people are eligible to use this loan application.

Features and benefits:

- MPokket is specially designed for students;

- The app is easy to use and offers student loans at competitive rates;

- Very few documents are required to pass loan authorization;

- Money is quickly credited to the account.

10. PaySense

It is the original digital platform to keep instant personal loans online. PaySense is a personal loan partner of IIFL and Fullerton.

Features and benefits:

- With this application you can get the maximum loan amount;

- The interest rate starts from 16.8% per annum;

- Based on your risk profile, the loan amount and the holding period are determined;

- After submitting the document (if you are eligible) the loan will be approved within 5 hours;

- It takes 3-5 days to receive funds using this application.

By choosing any of the listed Loan apps to take out loans online, you are making an informed choice. Each application is unique in its own way and enjoys some popularity among competitors.