People are always get fascinated by learning the use of advanced tools. In the CFD trading platform, you will learn about many advanced tools. Among them, the Fibonacci retracement tool is one of the most widely used tools by professional traders. Professional traders use the Fibonacci retracement tools to identify the endpoint of the retracement phase. The reason why the Fibonacci retracement tool is one of the most widely used tools is that it can be applied to any time frame and helps in identifying potential reversals in a market trend.

As a starter, you might be thinking that the Fibonacci retracement tools are only used to find the endpoint of the retracement. But if you do the proper research on the Fibonacci retracement tools, you will learn much advanced use. In this article, we are going to highlight five classic use of Fibonacci retracement tools.

1. Identifying the Retracement Phases

The professional traders use the Fibonacci retracement tools to identify the endpoint of the retracement phase. If you manage to find the end of a retracement, you can easily ride the major trend with a high level of accuracy. The trade will have a tight stop loss and thus you can increase the lot size without increasing the risk exposure. But remember, when you use to analyze the retracement phase of a trend, the retracement tools should be used in the higher time frame.

2. Riding the Trend

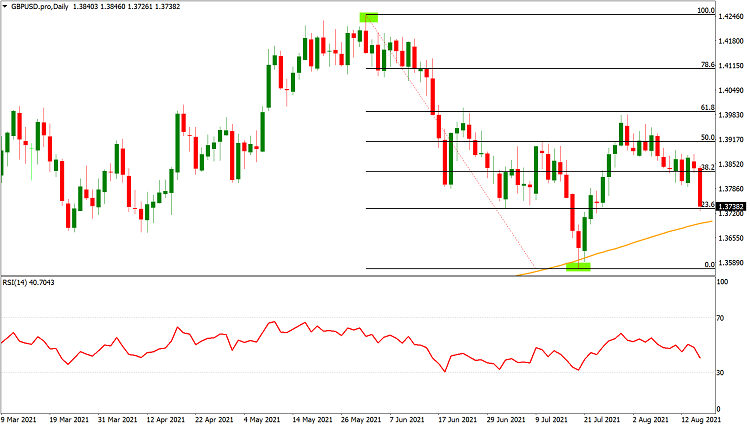

Once you learn to identify the endpoint of the retracement, you can use that level to execute the trade. But to improve your win rate, you should be looking for the confluence of retracement and other critical levels. For instance, if the price halts near the 38.2% retracement level, you should check the position of that retracement level.

The level should be close to the support level or else you should not execute any long trade. By using this simple technique, you can ride the major trend with a high level of accuracy. You may also use the news factors along with the technical data to improve your win rate.

3. Finding the False Signals

At times the trades become biased with the concept of trend trading strategy. They don’t even know the proper way to find the critical support and resistance level. For them, the Fibonacci retracement tool can be an excellent asset. Check here and learn more about the false trading signals generated in this market.

Once you become good at analyzing the false trading signal, you will no longer keep on losing money. In short, you can focus on high-quality trade execution and aim for bigger profit without having much trouble.

4. Identify the Major Reversal

The trend is not absolutely. If you think that you can keep on winning the trades by favoring the long-lasting trend in the market, you are walking on the wrong path. High impact news can alter the course of the trend within a minute. So, how do we identify the major change in the trend? The answer is really simple.

We can use the Fibonacci retracement tool and analyze the 61.8% retracement level. A candle closing above or below the 61.8% retracement level should act as a clear signal that the market is going to change its trend. Once you find such a break in the retracement level, you should prepare yourself to deal with the newly formed trend.

5. Scalping the Market

If you become skilled in using the Fibonacci retracement tool, you can set pending orders at the important Fibonacci retracement level. Many professional scalpers use this technique and recover their losses. But when your scalp is at the Fibonacci retracement level, you should carefully select the time frame. If you draw the retracement levels in the lower time frame, chances are very high that you will never learn to scalp the market like a pro trader.

You may also use the price action confirmation signals to the scalp at the important retracement levels. But try to avoid scalping during the news release hours. If you do so, you might face heavy slippage or lose money due to major changes in the trend. And do not forget to keep the risk factors low in each trade no matter which technique you use in the market.